Business Accounting Services In Eastwood

Trusted for over 30 years

At Robert Kim and Co, we’ve been helping business owners across Eastwood, Sydney, and beyond grow their wealth and minimise tax for over 30 years. One of our long standing clients, Hukuya — the much-loved local sushi restaurant and institution in the area — came to us for help with their business accounting over 20 years ago. Over the years, we've worked closely with them to establish the right tax structures and guide key business decisions that laid the foundation for a secure and comfortable retirement.

That’s always been our goal: to help businesses not only stay compliant but make smarter decisions that support long-term success. We go beyond the numbers to deliver tailored advice with strategies designed to support wealth creation and financial security over the long haul.

Whether you run a retail shop on Rowe Street, a medical practice in Ryde, or a growing service business elsewhere in Sydney, we understand the challenges local business owners face. Our clients stay with us because we take a hands-on approach — helping them navigate change, reduce risk, and plan with confidence. If you’re looking for business accounting services in Eastwood — or anywhere in Sydney — that offer practical advice and long-term planning, we’re here to help. At Robert Kim and Co, your future is our priority.

Call us today or book a consultation to discuss your tax strategy.

What Our Business Accounting Services Include:

Financial Reporting & Statements

Profit & loss, balance sheets, and financial reports.

Business Tax Return Preparation

Lodging company, partnership, and sole trader tax returns.

BAS & IAS Lodgements

Ensuring GST compliance and accurate reporting.

Business Structuring & Advisory

Setting up the right entity for tax efficiency.

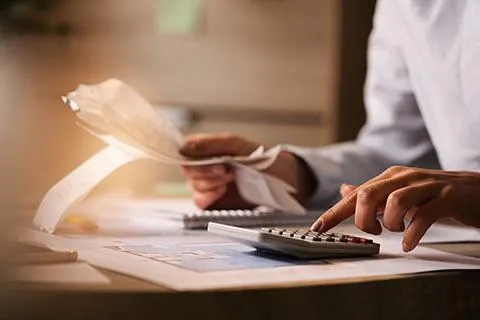

How Much Do Our Business Accounting Services Cost?

We charge based on the workload. This starts with an initial consultation to see what areas you need help with and based on the consultation we provide a scope of services. Our process of service is as follows:

Proposal

Pre-Engagement Meeting to understand Scope of Work.

Engagement Letter

Outline of scope, time and price is presented to you.

Delivery of Services

Any services outside the original scope are identified and agreed with you.

Completion of Services

Work is invoiced based on the agreed terms.

Steven B

Steven B

Robert has been my accountant for 22 years and he has always been professional and thorough with our financials. We would not be in the same financial position without Robert's advise and guidance, especially regarding superannuation.

Running a small business can be difficult, however Robert has assisted us throughout the years.

5 stars is not enough.

Why Businesses Trust Robert Kim and Co

With over 30 years of experience serving Eastwood and Sydney’s business community, Robert Kim and Co is known for long-term relationships, tailored advice, and real results. Many clients have relied on our strategic guidance to grow wealth and retire securely. We’re recognised in the local professional network for our integrity, transparency, and personalised service that puts your goals first.

Long term tax planning to increase your wealth

Business Tax Strategies

We help Australian businesses reduce tax legally through:

Tax-effective business structures, including sole trader, trust, and company structures.

Small business tax concessions and government incentives.

Fringe Benefits Tax and GST planning to avoid unnecessary tax liabilities.

ATO compliance and reporting to optimize tax savings.

Tax Strategies for Property Investors

Negative gearing and positive cash flow strategies to optimize deductions.

Depreciation schedules to maximize property tax savings.

Capital Gains Tax planning to reduce liabilities when selling property.

Land tax and ownership structuring to avoid unexpected tax bills.

Wealth Protection and High-Net-Worth Tax Strategies

Trusts and estate planning to optimize tax benefits and secure assets.

Income splitting strategies to legally minimize tax through family structures.

Superannuation tax planning to maximize retirement savings through tax-smart contributions.

Why Choose Robert Kim & Co for Tax Advisory?

More than 30 years of experience- We’ve been helping individuals and businesses navigate the Australian tax system for more than three decades—with proven.

Specialist in business and property investment tax- Robert is an experienced property investor himself, bringing real-world insight to every tax strategy he recommends.

Get in touch with us

Whether you have questions about our services or are ready to take control of your finances, we’re here to help. At Robert Kim and Co, we pride ourselves on providing personalized support and expert guidance to meet your accounting needs.

Contact us today to schedule a consultation or ask any questions you may have about business tax, bookkeeping, property investment. Our team is ready to assist you with clear, straightforward advice to help you achieve your financial goals.

(02) 9874 2366

Suite 2, 14 Ethel St, Eastwood NSW 2122

Send us a message

Get in touch with us

Whether you have questions about our services or are ready to take control of your finances, we’re here to help. At Robert Kim and Co, we pride ourselves on providing personalized support and expert guidance to meet your accounting needs.

Contact us today to schedule a consultation or ask any questions you may have about business tax, bookkeeping and property investment. Our team is ready to assist you with clear, straightforward advice to help you achieve your financial goals.

(02) 9874 2366

Suite 2, 14 Ethel St, Eastwood NSW 2122

Property tax and SMSF specialist | Business accounting, bookkeeping & payroll | Bilingual Korean-English services | Tax planning for families & businesses | Serving clients in Sydney & across Australia for 30+ years

Liability limited by a scheme approved under Professional Standards Legislation

Services

More

Contact Us

(02) 9874 2366

Suite 2, 14 Ethel St, Eastwood NSW 2122

Monday - Friday, 9:00 am - 6:00 pm